Like a closing down sale at a pound shop, Brexit keeps threatening to happen, but seemingly never does. The latest date we know is the 31st of October, which has always been synonymous with another scary fixture. So, how to manage the post-Brexit period as an accountant?

However, the tales around the campfire on Hallowe’en night seem positively tame to the scare stories and terrifying reports penned by experts, all pointing to disaster should leave the European Union without a deal.

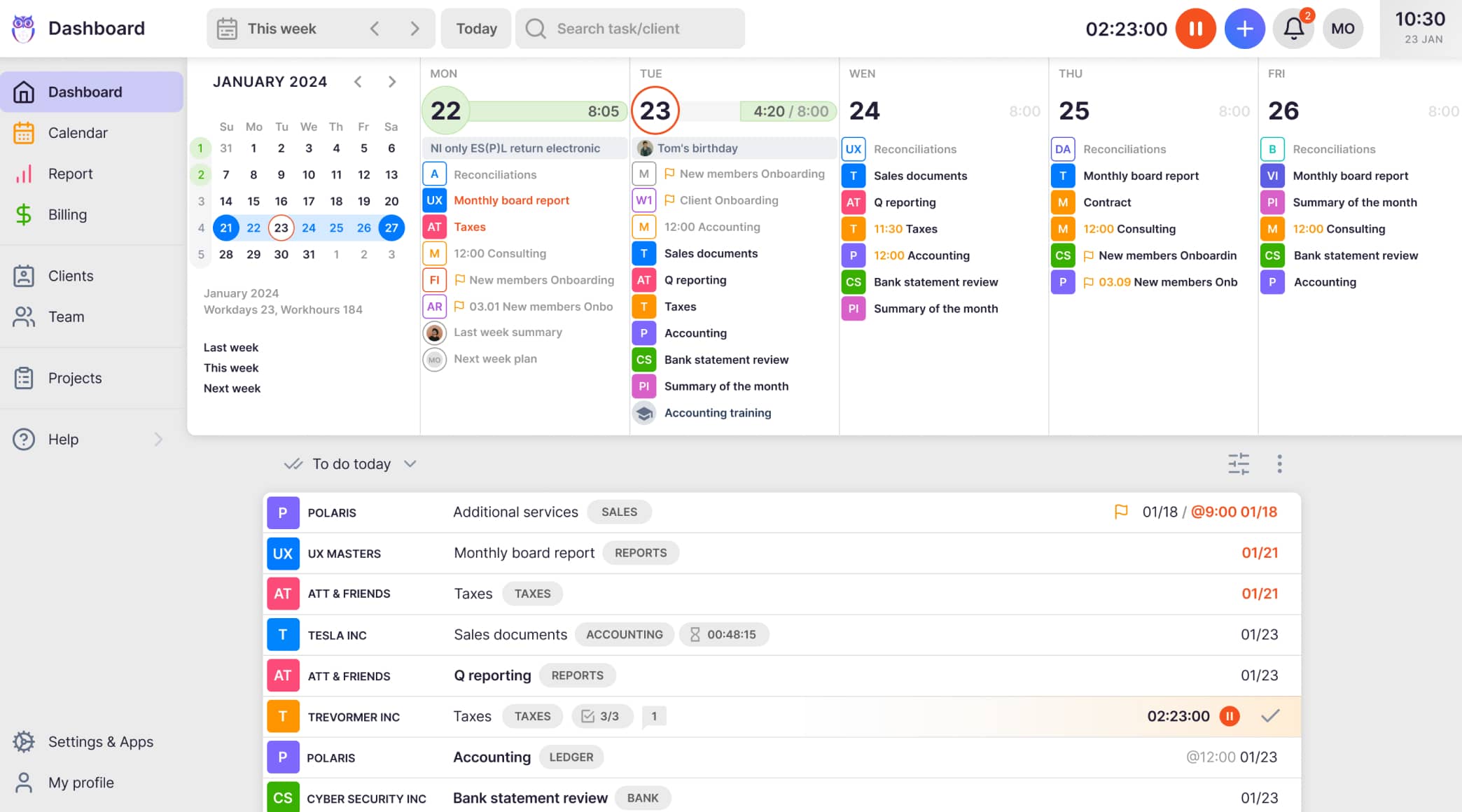

Article Summary:

- Prepare for Brexit now, no matter what you think will happen

- Customs toolkit

- VAT survival

Leaving on the 31st of October 2019 without a deal or a transition period is an increasingly real threat, meaning the UK will exit the Customs Union and the VAT taxation system.

Theresa May’s Withdrawal Agreement failed to make it past parliament, and Boris Johnson’s tweaks have not been well received by the EU at the time of writing this article – many suspect he is running down the clock, which could lead to all manner of legal complications.

Be ready, be prepared – do it now

Preparing your clients for the post-Brexit period is vital, as it’s looking likely. In the event of a no-deal Brexit at 11 p.m. on the 31st of October 2019, new trading and indirect tax rules will apply immediately.

- All goods crossing the border will become subject to import VAT for the first time, both ways.

- Tariff duties and custom declarations will need to be considered for all imports and exports after 11 p.m. on the 31st, causing potential chaos at the borders.

More pressingly, businesses now require action to lessen post-Brexit damage and facilitate a smooth transition.

Accountancy practice managers must take particular note at the post-Brexit period

Uku has curated a list of the most important measures that business owners need to implement now, to limit the damage caused by the likely customs and VAT shakeup post-Brexit.

There will be longer-term issues that must be addressed. These will include considerations about your licensing agreements and how all parties might be affected – your contracts with customers and suppliers must be updated, added or erased.

Currently, though, we are focusing on the short-term emergency strategies you can implement to protect your clients’ businesses as best you can in case of a no-deal Brexit.

We strongly advise that you and your clients begin making medium- and long-term plans for your practice for the coming weeks and months following this initial period.

Customs: A toolkit for damage limitation post-Brexit

Businesses may need to get EORI numbers for both the UK and the EU

If a company is based in the EU and wants to continue importing goods into UK ports, it’lll need to register with HMRC for a UK Economic Operators Registration Identification (EORI) number.

UK-based companies will have one of these automatically issued, but EU companies will need to apply to HMRC.

Companies based in the UK wanting to export to EU member states will need an EU EORI number, these can be applied for from any EU member state.

We recommend applying to the member state with which your clients do most trading, if possible.

Payable duties and VAT at customs

HMRC have a very useful tool that’ll help you calculate the amount of UK customs duties and import VAT tariffs due at the border for a consignment. This tool will also generate commodity codes for the goods that are to be imported.

If the goods leave the UK and enter the EU, the WTO MFN tariffs will be applied.

Please refer to your client logistics or freight partners for more information on these fees and how to find and use the available online tools with which to calculate them.

Dealing with customs declarations post-Brexit

Customs declaration forms must be filled out for all goods crossing UK and EU borders.

Luckily, there are several options for businesses affected by this.

The UK government provide training on the topic, complemented by a range of off-the-peg software that will take you through the key points step-by-step.

Again, you can also liaise with your logistics or freight partner for further guidance and information.

Save time and avoid stress with the Transitional Simplified Procedures scheme

Significantly reduce the paperwork and time spent at the border by enrolling with the government’s Transitional Simplified Procedures scheme.

Designed to make life easier for businesses importing into the UK, to help delays at UK customs.

Other schemes are aimed at assisting businesses with imports and exports, including a deferred customs clearance scheme and the ability to pay duties and import VAT from the border beforehand.

VAT: The essential knowledge for survival post-Brexit

In the case of Brexit, all goods arriving from the EU will be subject to a 20% UK import VAT levy.

To avoid making cash payments at the border, get your client to go through the HMRC ‘postponed accounting’ route. More information can be found on this page of the government’s web portal, gov.uk.

Businesses exporting goods to the EU must make a few changes to accounting practices. EU import VAT will be due on all exports from the UK entering an EU member state and will most likely be payable immediately, so provisions should be made and noted in the company accounts.

There will be changes to the standard UK VAT return in that postponed VAT must be declared in boxes 2 and 3 in the VAT return form.

All businesses affected by this should ensure they make the relevant changes within the accounting software.

VAT registrations in EU member states

Businesses based in the UK trading with the EU with a foreign VAT return will be required to have fiscal representation in the member state for which the VAT return needs to be completed.

Currently, 19 EU states require this, with several others accepting returns filled in and processed outside of the country.

Distance selling thresholds and VAT registration

Client companies based in the UK with UK VAT numbers that sell goods to EU consumers, typically as merchants through the internet on an e-commerce basis, will need to register for VAT in a member state to service the EU market.

This is a result of the distance selling threshold.

The importing of low value good under £135

Any client business importing goods in individual parcels with a value lower than £135, with the sole intention of reselling these items to UK consumers, will be required to join HMRC’s parcel scheme.

This will include parcels worth £15 or less as the existing Low-Value Consignment Relief (LVCR) will no longer apply.

Digital services and MOSS

UK-based businesses selling digital services to EU consumers must register for VAT Mini One Stop Shop (VAT MOSS). A single VAT return can be submitted in any EU member state, and the dues paid in the member state.

Reclaiming VAT after a no-deal Brexit

After the 31st of October 2019, UK-based businesses cannot claim back VAT from EU transactions through the VAT recovery portal.

If you have outstanding claims, it is advised that you complete the process to have the amounts returned before Brexit. The same applies if you are an EU-based company without outstanding UK VAT claims.

The lowdown

Accounting practice managers must ensure they maintain a solid overview of the work involved for each client.

Extra work will pile up, so your clients must be prepared to cover any extra charges that may be incurred from Brexit preparations, and it’s your responsibility to keep track and bill accordingly. Practices that respond rapidly and effectively to seismic changes in the fiscal landscape – either due to Brexit or otherwise – will always retain a competitive advantage.

When writing this article, the UK is on course to leave the EU without a deal on the 31st October 2019. Europe has clarified that any rehashing of the original withdrawal deal that was recently submitted will not be acceptable, giving the UK a clear ultimatum of no-deal Brexit or Brexit extension.